Australia’s Used Car : The Australian automotive landscape is experiencing a remarkable transformation, with the used car sector emerging as a powerhouse of economic activity.

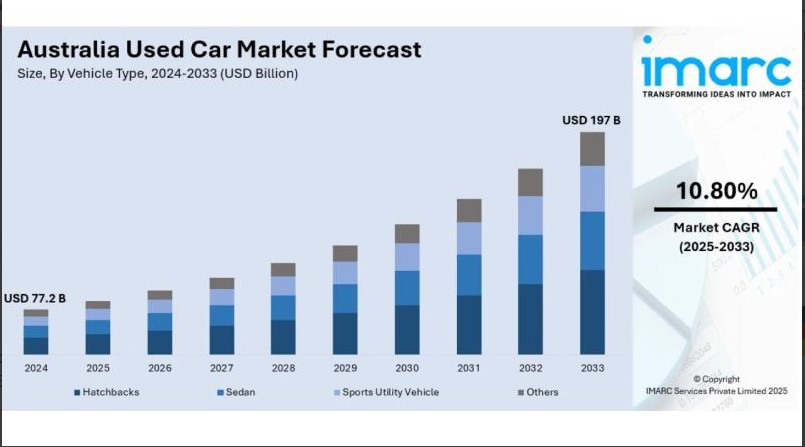

The Australia used car market size reached USD 77.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 197 Billion by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033.

This extraordinary expansion represents more than just numbers on a spreadsheet—it reflects changing consumer behaviors, economic pressures, and evolving preferences that are reshaping how Australians approach vehicle ownership.

The Current Market Landscape: A Robust Foundation

Australia’s used car market stands on remarkably solid ground, having demonstrated impressive resilience throughout recent economic uncertainties. According to the report, total used car sales in 2024 reached 2,324,805 units, a 12.1 per cent increase compared to 2023.

This substantial growth occurred despite various economic headwinds, demonstrating the fundamental strength of the pre-owned vehicle sector.

The market’s performance throughout 2024 tells a compelling story of sustained demand followed by natural market corrections. Sales peaked in July, with sustained demand throughout much of the year before easing towards the end.

This pattern reflects typical seasonal variations combined with broader economic factors influencing consumer purchasing decisions.

Market Leaders and Popular Choices

Toyota remained the top-selling brand, with 390,298 used vehicles sold, followed by Mazda and Ford. Among individual models, the Ford Ranger led with 82,448 sales, ahead of the Toyota Hilux and Toyota Corolla.

These figures highlight Australian consumers’ enduring preference for reliable, practical vehicles that can handle the country’s diverse terrain and weather conditions.

The dominance of utility vehicles and SUVs in sales figures reflects Australians’ lifestyle preferences and practical needs. Whether navigating urban environments or exploring the vast outback, consumers gravitate toward vehicles offering versatility, durability, and proven reliability records.

Economic Drivers Fueling Market Growth

Affordability Crisis in New Vehicle Market

The Australia utilized car advertise is encountering strong development, driven by reasonableness concerns, rising modern car costs, and the expanding request for solid pre-owned vehicles. This affordability challenge has created significant opportunities in the used car sector, as consumers seek value-driven alternatives to increasingly expensive new vehicles.

Rising new vehicle costs stem from multiple factors, including global supply chain disruptions, inflation in manufacturing costs, and increased complexity in modern automotive technology. These pressures have made used cars an attractive proposition for budget-conscious consumers who refuse to compromise on quality or reliability.

Economic Climate and Consumer Behavior

Australia’s economic environment plays a crucial role in shaping used car market dynamics. The economy is expected to recover gradually in 2025, with GDP growth projected to reach around 2%, driven by rising household incomes, a rebounding housing market, and expectations of rate cuts. However, current economic pressures continue influencing consumer decisions.

Inflation held steady at 2.5% in January, but trimmed mean inflation rose slightly to 2.8%, indicating persistent inflationary pressures despite easing rent prices. These conditions encourage consumers to seek cost-effective transportation solutions, positioning the used car market as an attractive alternative to new vehicle purchases.

Digital Transformation: Revolutionizing the Purchase Experience

Online Platform Growth

The Australia online car buying market size reached USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.8 Billion by 2033, exhibiting a growth rate (CAGR) of 9.50% during 2025-2033. This rapid digital adoption reflects fundamental changes in how Australians research, evaluate, and purchase used vehicles.

Digital platforms offer unprecedented transparency and convenience, providing detailed vehicle histories, comprehensive pricing information, and streamlined transaction processes. Online sales of both new and used cars have increased by 15% in 2024, with more consumers appreciating the convenience and transparency these platforms offer.

Enhanced Consumer Confidence

The expansion of advanced stages has rearranged exchanges, advertising straightforward estimating and point by point vehicle histories, in this manner improving customer certainty. This technological advancement addresses traditional concerns about used car purchases, including uncertainty about vehicle condition, pricing fairness, and transaction security.

Modern online platforms provide comprehensive vehicle inspection reports, detailed maintenance histories, and competitive pricing comparisons, enabling informed decision-making processes that previously required extensive research and expertise.

Market Dynamics and Current Trends

Cooling Period and Market Stabilization

While growth remains strong, the market experienced some moderation in late 2024. “Profit margins tightened, and days to sell increased by 15 per cent for listings between August and October, further indicating a slowdown in demand. As we head further into 2025, we anticipate a more subdued market, with sales likely to stabilise rather than grow at the rapid pace we saw earlier in 2024,” said Mr Voortman.

The average time to sell a used vehicle has climbed to 48.7 days, the highest since October. This indicates slower-moving stock and a challenging environment for sellers. This adjustment represents a natural market correction rather than fundamental weakness, creating more balanced conditions for both buyers and sellers.

Price Adjustments and Value Retention

According to recent reports, prices for used cars have decreased by around 5-8% compared to 2023, with luxury and 4WD vehicles experiencing the sharpest drops. These price adjustments create opportunities for consumers while encouraging more realistic pricing expectations among sellers.

Australia saw a peak in March 2022 at 154 per cent compared to pre-pandemic levels. By September 2024, the index had dropped to 121 per cent. This gradual price normalization reflects improved supply conditions and more balanced market dynamics.

Segment Analysis: Understanding Consumer Preferences

SUV Dominance Continues

Sports utility vehicles hold 23.1% of the market share. They offer a combination of space, comfort, and versatility, making them popular among families and adventure seekers. This segment’s strength reflects Australian lifestyle preferences, outdoor recreation trends, and practical transportation needs.

The SUV segment’s appeal extends beyond utility, encompassing safety perceptions, elevated driving positions, and social status considerations. Sales of 4WDs and off-road vehicles have increased by 8% in 2024, reflecting Australians’ preference for versatile vehicles capable of tackling the country’s varied terrains.

Electric and Hybrid Vehicle Integration

The Australia used car market is witnessing a significant rise in demand for fuel-efficient and eco-friendly vehicles, including hybrids and electric models. This trend reflects growing environmental consciousness and rising fuel costs, creating new opportunities in the used EV market.

The MG4 has reclaimed its position as Australia’s most popular used electric vehicle (EV). Despite this, the used EV market faces challenges. Oversupply of new EVs has led to a decline in retained values, encouraging shorter ownership cycles for sellers.

Regional Market Variations

Market performance varies significantly across Australian regions, reflecting local economic conditions, population growth, and infrastructure development. Western Australia and the Northern Territory were the only regions where the number of cars listed for sale increased. These regional variations create diverse opportunities and challenges for market participants.

Urban centers typically demonstrate stronger demand for compact vehicles and fuel-efficient options, while regional areas favor utility vehicles and four-wheel drives. Understanding these regional preferences becomes crucial for dealers, manufacturers, and consumers navigating the market.

Future Outlook: Sustainability and Growth Drivers

Environmental Considerations

Sustainability Considerations: Developing natural mindfulness has driven shoppers to consider utilized cars as a economical choice, decreasing the natural affect related with fabricating modern vehicles. This move adjusts with broader supportability objectives and advances the circular economy.

The used car market’s role in environmental sustainability extends beyond individual consumer choices, contributing to resource conservation and reduced manufacturing demand. This environmental angle adds another dimension to the market’s appeal, particularly among environmentally conscious consumers.

Infrastructure and Support Systems

Moreover, the accessibility of certified pre-owned programs and adaptable financing alternatives has extended the market’s offer to a broader client base. These support systems enhance market accessibility while providing consumer protection and confidence.

Financing innovations, warranty programs, and quality assurance initiatives continue expanding market reach, making used vehicles accessible to broader demographic segments and income levels.

Challenges and Opportunities Ahead

Market Stabilization Benefits

While new car sales may decline slightly, the used car market will stabilise, offering greater affordability. This stabilization creates opportunities for strategic market entry and expansion while providing consumers with more predictable pricing environments.

For buyers, the current market conditions represent an ideal time to find deals, particularly on EVs and other segments experiencing value drops. These conditions favor consumers while challenging market participants to adapt strategies and operational approaches.

Long-term Growth Sustainability

The projected growth trajectory from $77.2 billion to $197 billion represents sustainable expansion rather than speculative bubbles. This growth foundation rests on demographic trends, urbanization patterns, economic development, and evolving transportation needs that support continued market expansion.

Market participants positioning themselves strategically can capitalize on this growth while contributing to more efficient, sustainable, and accessible transportation solutions for Australian consumers.

FAQs

Q: What factors are driving the Australian used car market’s growth to $197 billion by 2033? A: The growth is primarily driven by rising new vehicle costs, affordability concerns, increased digital platform adoption, and growing demand for reliable pre-owned vehicles with transparent pricing.

Q: How has the used car market performed in 2024 compared to previous years? A: The market showed strong performance with 2,324,805 units sold (12.1% increase), though momentum slowed in the final months with days to sell increasing to 48.7 days.

Q: Which vehicles are most popular in Australia’s used car market? A: Toyota leads with 390,298 used vehicles sold, while the Ford Ranger topped individual models with 82,448 sales, followed by Toyota Hilux and Corolla.